Sector Funds

Fiducian’s four highly rated sector funds invest in a diversified group of investment managers with expertise in each sector.

Diversification between fund styles

Investors receive the proven benefits of diversification between fund manager styles within each sector and can build a portfolio from a combination of one or all of the following sector funds:

- Fiducian Australian Shares Fund

- Fiducian International Shares Fund

- Fiducian Australian Smaller Company Share Fund

- Fiducian Property Securities Fund

Fiducian’s Australian Shares Fund and Property Securities Fund are each rated five stars (the highest possible) by independent ratings agency Morningstar, with the Australian Smaller Company Share Fund rated four stars.

On this page

Who would the Fiducian Australian Shares Fund suit?

It is recommended that investment in the Fiducian Australian Shares Fund be undertaken for at least five to seven years. Share investment can be volatile over the short-term.

Benefits of investing in the Fiducian Australian Shares Fund

Using the Manage the Manager System of investment management for the Fiducian Funds, we invest in a blend of well-researched fund managers who are selected for their expertise and their investment styles. Fiducian has six (6) different fund manager teams managing your money in the Australian Shares Fund. The key benefits of investing in the Fund for you and your Financial Adviser are:

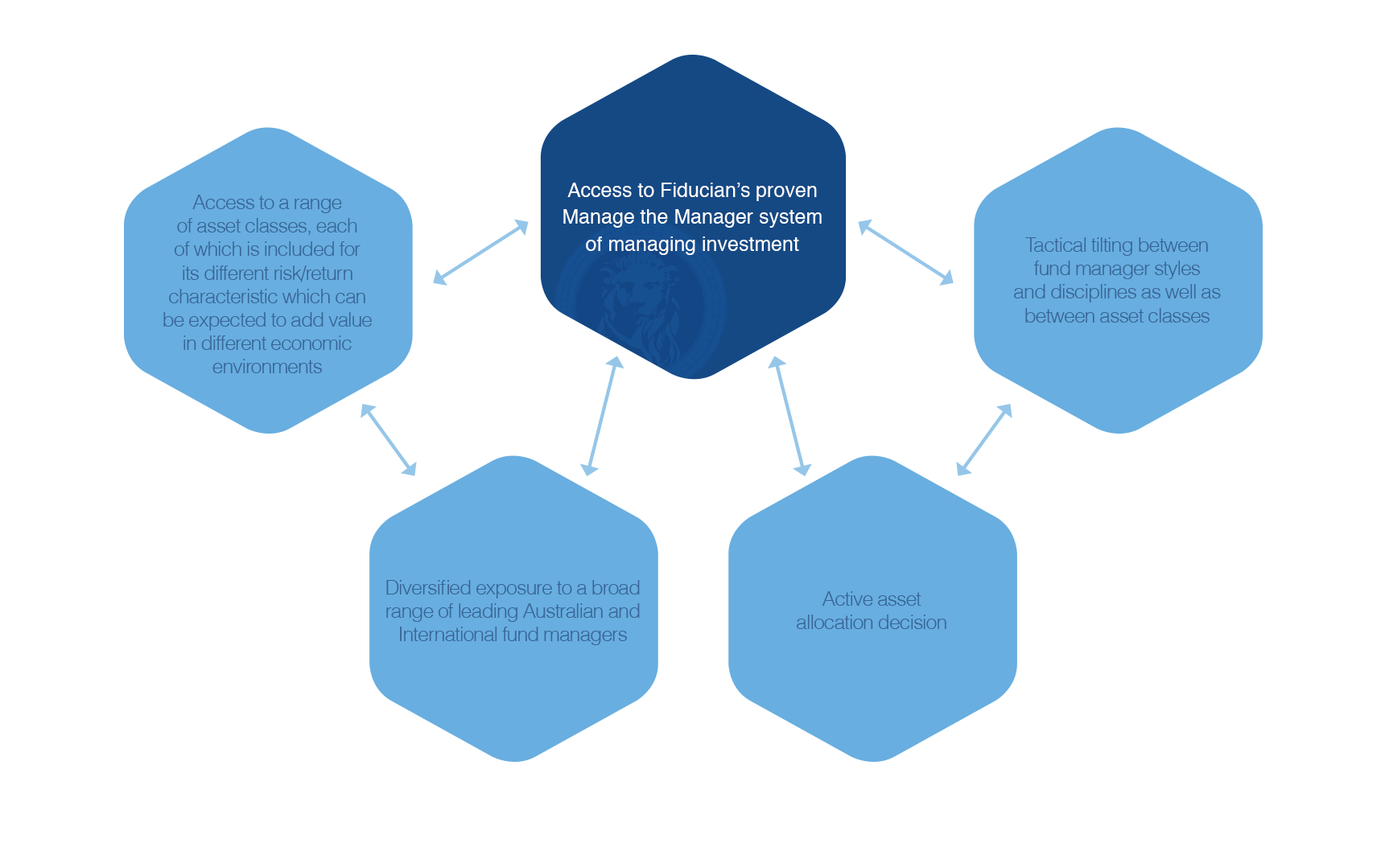

• Access to Fiducian’s proven Manage the Manager System of managing investments

• Diversified exposure to a broad range of leading Australian and international fund managers

• Active asset allocation decisions

• Tactical tilting between fund manager styles and disciplines as well as between asset classes

Disclaimer:

Information on this website is intended to be general information only and does not constitute investment or financial product advice. It does not take into account any person's objectives, financial situation or needs. You should conduct your own investigation or consult a financial adviser, and consider the relevant Target Market Determination (TMD) and Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold any financial product.

The Responsible Entity for Fiducian Funds is Fiducian Investment Management Services Limited ABN 28 602 441 814 AFSL 468211.

Who would the Fiducian International Shares Fund suit?

It is recommended that investment in this Fund be undertaken for at least five to seven years. International share investment can be volatile over the short-term.

Benefits of investing in the Fiducian International Shares Fund

Using the Manage the Manager System of investment management for the Fiducian Funds, we invest in a blend of well-researched fund managers who are selected for their expertise and their investment styles. Fiducian has eight (8) different fund manager teams managing your money in the International Shares Fund. The key benefits of investing in the Fund for you and your Financial Adviser are:

• Access to Fiducian’s proven Manage the Manager System of managing investments

• Diversified exposure to a broad range of leading Australian and international fund managers

• Active asset allocation decisions

• Tactical tilting between fund manager styles and disciplines as well as between asset classes

Disclaimer:

Information on this website is intended to be general information only and does not constitute investment or financial product advice. It does not take into account any person's objectives, financial situation or needs. You should conduct your own investigation or consult a financial adviser, and consider the relevant Target Market Determination (TMD) and Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold any financial product.

The Responsible Entity for Fiducian Funds is Fiducian Investment Management Services Limited ABN 28 602 441 814 AFSL 468211.

Who would the Fiducian Australian Smaller Company Shares Fund suit?

It is recommended that investment in this Fund be undertaken for at least five to seven years. Share investment can be volatile over the short-term.

Benefits of investing in the Fiducian Australian Smaller Company Shares Fund

Using the Manage the Manager System of investment management for the Fiducian Funds, we invest in a blend of well-researched fund managers who are selected for their expertise and their investment styles. Fiducian has six (6) different fund manager teams managing your money in the Australian Smaller Companies Shares Fund. The key benefits of investing in the Fund for you and your Financial Adviser are:

• Access to Fiducian’s proven Manage the Manager System of managing investments

• Access to a range of asset classes, each of which is included for its different risk/return characteristics which can be expected to add value in different economic environments

• Diversified exposure to a broad range of leading Australian and international fund managers

• Active asset allocation decisions

• Tactical tilting between fund manager styles and disciplines as well as between asset classes

Disclaimer:

Information on this website is intended to be general information only and does not constitute investment or financial product advice. It does not take into account any person's objectives, financial situation or needs. You should conduct your own investigation or consult a financial adviser, and consider the relevant Target Market Determination (TMD) and Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold any financial product.

The Responsible Entity for Fiducian Funds is Fiducian Investment Management Services Limited ABN 28 602 441 814 AFSL 468211.

The Fiducian Property Securities Fund

The Fiducian Property Securities Fund invests in a diversified group of three (3) specialist property managers that invest in property trusts and other property securities listed on the Australian Stock Exchange. Property investments can provide attractive levels of income with a small amount of growth in the value of capital invested. Listed property trusts have generally been found to deliver returns that are on average below the returns from shares, but which also tend to exhibit lower variance in price during share market declines. Property sectors include commercial, retail, tourism and residential property. Companies include property investment, development, contracting, tourism and leisure activities.

Who would the Fiducian Property Securities Fund suit?

It is recommended that investors in this Fund should plan to hold their investments for at least four to six years. Investment in this sector can be volatile over the short-term.

Benefits of investing in the Fiducian Property Securities Fund

Using the Manage the Manager System of investment management for the Fiducian Funds, we invest in a blend of well-researched fund managers who are selected for their expertise and their investment styles. Fiducian has three (3) different fund manager teams managing your money in the Property Securities Fund. The key benefits of investing in the Fund for you and your Financial Adviser are:

• Access to Fiducian’s proven Manage the Manager System of managing investments

• Access to a range of asset classes, each of which is included for its different risk/return characteristics which can be expected to add value in different economic environments

• Diversified exposure to a broad range of leading Australian and international fund managers

• Active asset allocation decisions

• Tactical tilting between fund manager styles and disciplines as well as between asset classes

Disclaimer:

Information on this website is intended to be general information only and does not constitute investment or financial product advice. It does not take into account any person's objectives, financial situation or needs. You should conduct your own investigation or consult a financial adviser, and consider the relevant Target Market Determination (TMD) and Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold any financial product.

The Responsible Entity for Fiducian Funds is Fiducian Investment Management Services Limited ABN 28 602 441 814 AFSL 468211.

Benefits of investing in the Fiducian Funds