Fiducian Funds

Fiducian is a specialist financial services company offering a wide range of investment choices to our clients. Your Fiducian Financial Adviser works with you to develop your wealth creation strategy and financial plan to suit your financial and lifestyle goals. Our objective is to build lasting relationships with our clients and work with them through a personalised approach and building trust through quality financial advice

The Fiducian suite of funds

With over 20 years’ proven success, we provide our clients with a highly effective Manage the Manager System (Multi-Manager). It can be customised to the unique needs of each client coupled with the highest quality of financial and lifestyle advice as well as exceptional client service. Our investment process is designed to deliver greater diversification, consistent above average returns with reduced risk and volatility over the medium to longer term.

We offer our clients and their financial advisers a range of 14 Fiducian funds: four diversified funds, and 10 sector funds with access to 40 underlying investment manager teams.

Fund Range

Notice to members regarding change in Fiducian Fund auditors from PwC to KPMG:

Fiducian Funds Audit and Compliance Plan Audit

Fiducian Manage the Manager Investment Philosophy

10 Sector Funds - 4 Diversified Funds - 40+ Underlying Investment Manager Teams

Managed Share Portolio

You also have the option of directly owning a limited number of listed securities such as shares or property trusts. Within the Fiducian collection, there are four managed share portfolios including a property securities portfolio. The Fiducian investment team manages your share portfolio for you, so you do not have to worry about selection or alteration to the portfolio of securities.

- Imputation Portfolio (14 securities)

- Growth Portfolio (14 securities)

- Property Securities Portfolio (8 securities)

- Emerging Leaders portfolio (14 securities) between 70 and 200 in ASX capitalisation

Who manages the Fiducian Funds?

Fiducian has an experienced and expert in-house investment team responsible for managing the Fiducian Funds, including fund manager selection and active ongoing portfolio management.

Fiducian Investment Management Services Limited is the ‘Responsible Entity’ of each of the Fiducian Funds.

How are the funds managed?

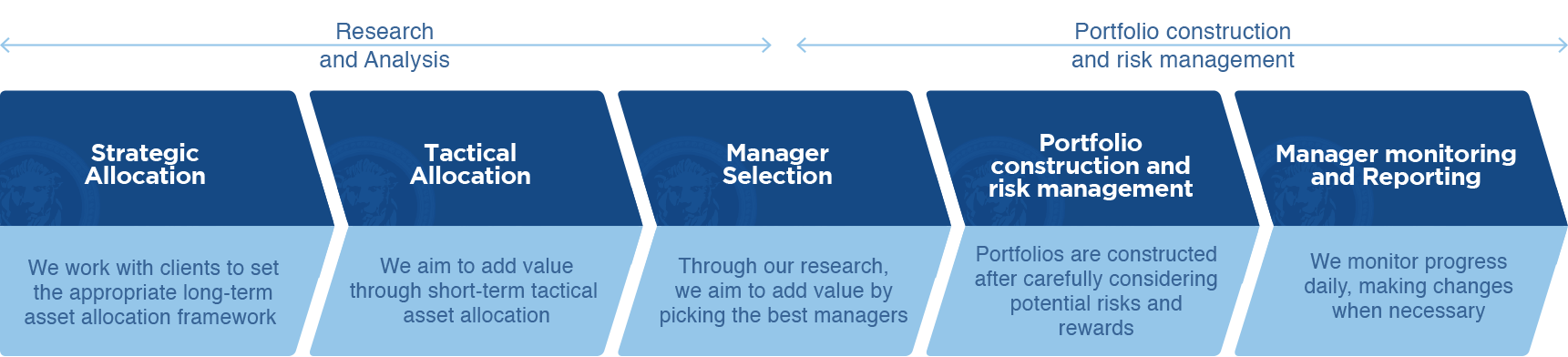

Using our ‘Manage the Manager’ system, we combine a variety of fund managers, such as growth and value managers into one fund. Our Investment team conducts ongoing extensive research both in Australia and overseas to source the best fund managers for inclusion in a Fiducian portfolio.

We apply a carefully structured research process to the selection of funds and other products. This process involves the application of quantitative and qualitative analysis to identify well performing funds, managed by competent and experienced investment teams who are assessed as being able to achieve consistently good performance over time without taking excessive risks.

The Investment Team also makes active asset allocation decisions within the Fiducian Funds, both between managers as well as between asset classes. These decisions are the culmination of strategy decisions taken by the Investment Team on the basis of detailed economic, market and fund performance analysis.

How can you invest in the Fiducian Funds?

The full range of Fiducian Funds is available through:

Have a chat with your financial adviser to find out more about investing in the Fiducian Funds.

Your own share portfolio minus the hassle

If you’d prefer to invest in your own portfolio of shares or listed property trusts you can choose from three share portfolios and a property securities portfolio. These Fiducian Personal Managed Share Portfolios offer the benefits of direct ownership of a portfolio of shares or listed property trusts but without the time-consuming work of managing the holdings and continually monitoring the performance of each company in which shares are held

Read the latest performance report