Technology as an investment sector has performed well over the last decade. Is Artificial Intelligence (AI) going to be the key driver of returns for the sector over the coming decade and what other dynamic technology sectors could potentially reward investors?

Artificial Intelligence (AI) is a broad term that describes how computers are able to solve problems and process information in a similar way to the human brain. Typically, computer programs have been efficient at processing strictly defined instructions inputted by a programmer or by a user. AI technology seeks to expand this so that computers can also recognise patterns, anticipate future actions and make decisions without much outside input.

Examples of how AI technology is already being used today include self-driving vehicles, medical research and cybersecurity. The public launch of ChatGPT, a text-based AI program that allows a user to write a prompt and receive a detailed answer, has brought AI technology into public consciousness. Anyone with a Google account can sign up for free and then find ways to use the program to write assignments, create computer program code, plan holidays, create recipes or perform any number of other tasks. The CEO of Microsoft recently stated that soon ‘every product of Microsoft will have AI capabilities to completely transform it’.

The potential rise of AI has some parallels with the development of so-called ‘cloud computing’. Cloud computing really has nothing to do with clouds but is actually a huge data storage system. Data is stored on thousands of ‘servers’ in enormous data centres, which enable data to be accessed from anywhere by use of the internet. Not only does this allow people to store huge quantities of information (including photos, movies or computer programs) and access this through any device but it also enabled people to work from home, a trend that was accelerated by the pandemic and which remains popular to this day. Enormous value has been created by companies that have been able to take advantage of this technology.

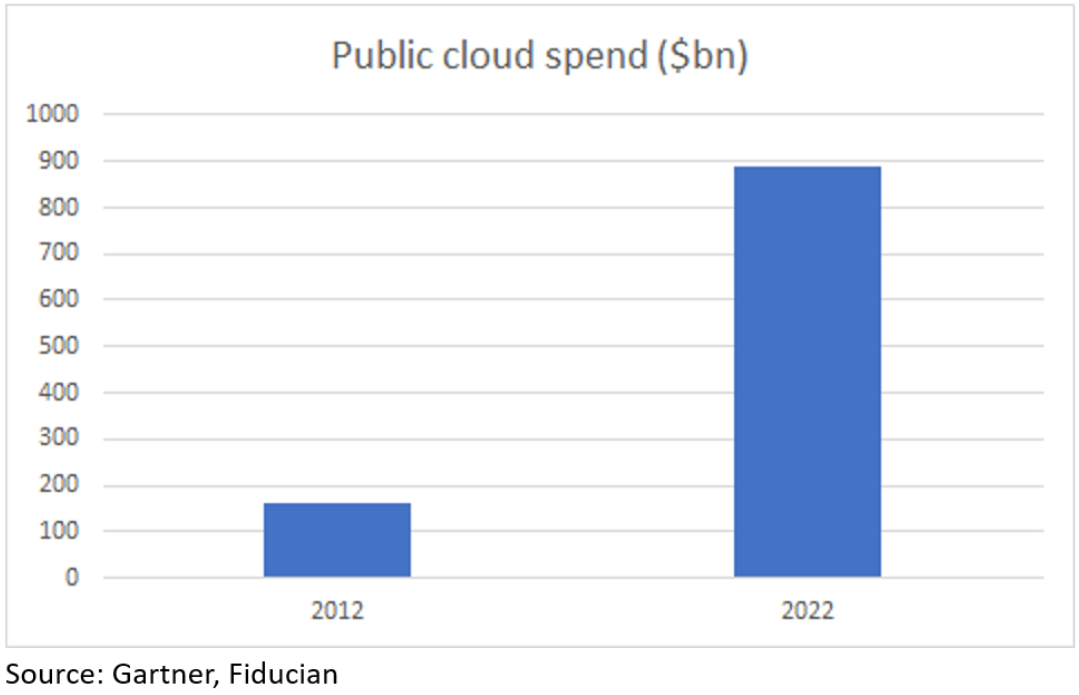

As the chart below shows, ‘public cloud’, the largest subset of cloud computing, has grown by around 40% per annum over the past 10 years, with annual spending approaching $US1 trillion.

Why should Technology be on Australian investors’ radar right now, especially for those seeking ways to enhance long-term returns?

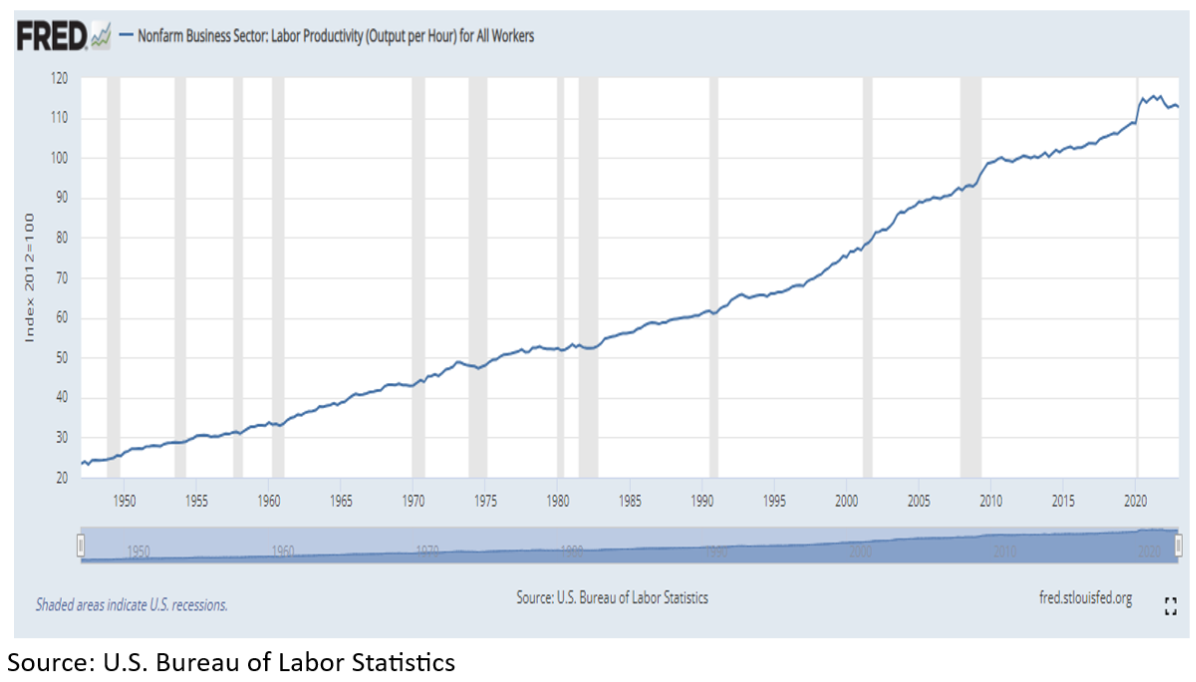

Technology has always been the key driver of productivity growth. As an economy becomes more productive, it can create more output per unit of input. The chart below sets out the cumulative gains in US productivity over the last 70 years. Over the period from 1990, output per hour in real terms for the average American worker has more than doubled.

In recent years, productivity growth in most of the advanced economies has been slower than long-term trends and combined with declining fertility rates across these countries, could presage an extended period of relatively low economic growth. In this environment, technological innovation remains the best hope for enabling economies to return to higher long-term economic growth rates.

What are some of the risks of investing in Technology?

Occasionally, the promises of new technologies fail to live up to the initial hype (such as blockchain or 3D printing in recent years). In other cases, it can be too expensive to develop particular technologies as, for example, their potential uses may be very limited. However, in the case of AI, the outlook appears to be very positive. The potential uses of this technology are very broad and uptake has already been rapid. It took ChatGPT only 2 months to reach 100 million active users. This compares with TikTok (the previous record holder), which took 9 months to reach the same level or Uber, which took almost 6 years. Certainly too, in terms of relevance for investors, the technology sector, as with many other dynamic market sectors (such as emerging markets), is likely to be more volatile than many broad established markets and investors should only be aiming to invest a small part of their overall investment funds in this market and should be investing for the long-term only.

The Fiducian Technology Fund saw returns of 5.3% for the year to 30 June 2023. What has changed since the fund was achieving double-digit positive returns in 2020-21?

The Fiducian Technology Fund, as is the case for any fund invested in dynamic markets, can be expected to be highly volatile at times. This is why returns should only be assessed over the longer-term. For example, the annual average return for this fund over the 10 years to 30 June this year was 15.2%, which is well above the 8.5% average annual return for the broad Australian share market. The advantage of the Fiducian Technology Fund, compared with other technology funds, is that it is well diversified across managers (three respected international-based managers focused on different sectors of the global technology market) and, especially importantly, has considerable exposure to the small and mid-cap sectors, which many technology funds lack. This exposure can add to short-term volatility but longer-term can potentially bring above-index returns, as has been the case over the last decade. Strong long-term out-performance can be anticipated because the small and mid-cap sectors of the market are where the innovation of the technology sector comes through and can be accessed by investors. This is where the enormous growth of this most dynamic sector of the global economy shows up but it comes with an expectation of short-term high relative volatility.