Millennials are the winners in 'The Great Wealth Transfer'

Published 4 October 2022

According to the 2021/22 edition of The Boomer Guide, Baby Boomers are spending their wealth more than any other generation. A recent study by the Productivity Commission has revealed Baby Boomers will pass on a whopping $224 billion each year in inheritances by 2050.

If you’re part of the windfall, there are three key areas you need to focus on to protect and grow your inheritance.

Financial planning

As Benjamin Franklin once said, “If you fail to plan, you are planning to fail”. The same applies to boosting and protecting financial wealth.

Financial planning will ease the stress of protecting your wealth by allowing you to build a nest egg for your long-term financial goals. It also allows you to maximise your return on investment by providing a clear roadmap for your financial future.

It’s important to remember financial planning isn’t only about setting yourself up for retirement. It’s also about establishing major financial goals along the way which may include purchasing a car, planning a holiday or renovating your home. Setting mid-term financial goals also allows you to experience some financial freedom as you work towards your big goal of retiring comfortably.

Long-term investing

Long-term investing typically looks at investments spanning ten years and beyond.

The benefits of long-term investments include being able to ride out any downturns in the market and allowing your investments to have more time to appreciate. This process has almost always proven to deliver a solid return over time.

But is there a secret to ensuring you win when it comes to your long-term investments? The key is putting your money into long-term investments where you will not need a return in the short-to-medium term.

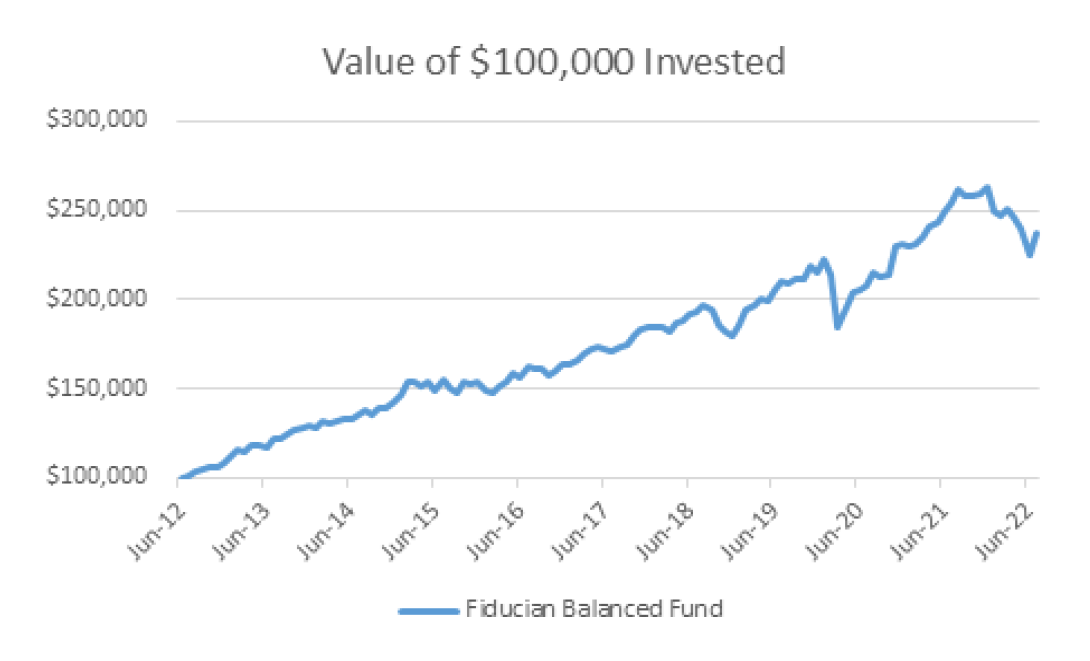

The chart shows an example of how investing $100,000 in a long-term Fiducian Balanced Fund has doubled returns over a ten-year period.

* Past performance is not a reliable indicator of future performance and Fiducian and the Fiducian Group does not guarantee the performance of the Fund or any specific rate of return.

Shorter term strategies

Depending on the amount you are dealing with, you may be able to invest in shorter term, higher return assets to allow you to reap the benefits for more immediate needs such as property improvements, and education.

A financial planner will take all your mid-term and long term needs into account when helping you create your strategy.

Maximising your superannuation

Another great way to protect your wealth is by maximising your superannuation.

Before you look at maximising your super, you need to ensure it’s in one place. According to the Australian Taxation Office (ATO) around four million Australians hold two or more super accounts, all being charged more than one set of fees.

Once you consolidate your super, here are a few other factors to consider:

- Know how your super is being invested: being across how and where your super is being invested is important because it is likely one of the biggest investments you have.

- Consider voluntary contributions: remember, the idea of super is for you to access it later on in life, so topping up contributions can really help bolster your balance.

- Check your employer contributions: it’s important to work out if changing funds will affect how much your employer contributes as some employers contribute more to certain funds.

- Check your insurance cover: before you leave a fund, check to see if you have any insurance through the fund. This might be life, total and permanent disability (TPD), and/or income protection insurance.

- Be cautious when changing funds: if you switch funds, you might not be able to get the same insurance cover. Be particularly wary if you have a pre-existing medical condition or are aged 60 or over.

- And last but not least, if you're unsure about any of the recommendations made above, get advice from a financial adviser.