A closer look at emerging markets

The Indian economy has emerged from the COVID-19 pandemic in a strong position. Government fiscal support and accommodative monetary policy have set the base for a strong rebound in activity in the near term, and longer term economic reforms combined with positive demographic factors are supportive of elevated growth over the long term.

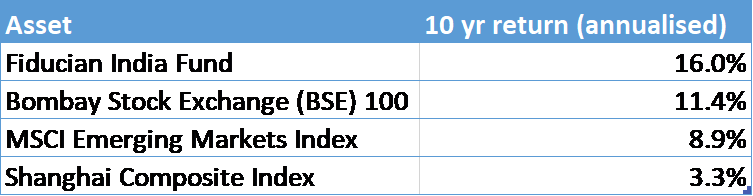

The Fiducian India Fund has delivered strong returns for investors over the last 10 years. Performance has been above its own benchmark (BSE 100) and a range of other emerging market indices.

Given the high growth nature of emerging market economies, there is the potential to capture outsized returns, but this is usually accompanied by higher risk. The Fiducian India Fund has experienced relatively high volatility, comparable to other emerging market equities, but how does it fit as a part of a diversified fund? And what is the exposure to the Indian growth story in mainstream emerging market and Asia focused funds?

Risk at a portfolio level

Investors will typically hold a large number of different assets. The idea that diversification can help to achieve superior returns for lower levels of risk is a key tenets of finance theory, and one of the driving philosophies of the Fiducian ‘Manage the Manager’ system.

On a standalone level, the observed volatility of the Fiducian India Fund is high relative to a range of other well-known market indices, as measured by the standard deviation of returns over 10 years.

But this only tells one part of the story. The real benefits of diversification come when assets move in a different manner from each other. For example, holding two different Australian bank shares in your portfolio will do little to achieve diversification. Both will have the same underlying earnings drivers- interest rates, bad debt charges, and domestic economic conditions. On the other hand, combining a bank share with a mining stock will offer superior diversification. The earnings of a resources company will be dictated by the supply and demand conditions of the commodity that the company mines, and more so by global economic activity compared to the local economy. The returns of these different stocks will be less correlated- they will move differently from each other.

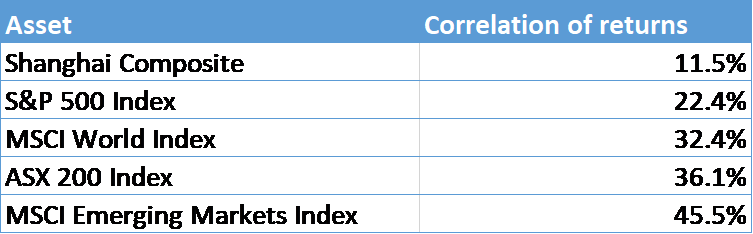

A key feature of the Fiducian India Fund over the last decade has been a relatively low correlation with other markets. The lower the correlation, generally the higher benefits available from diversification. The table below shows the correlation of the Fund with a selection of global stock indices:

By way of comparison, the correlation of the Australian stock market to the US stock market over the last 10 years has been 70.0%, so a correlation of 45.5% between the MSCI Emerging Markets Index and the Fiducian India Fund is relatively low.

Increasing the tilt towards India

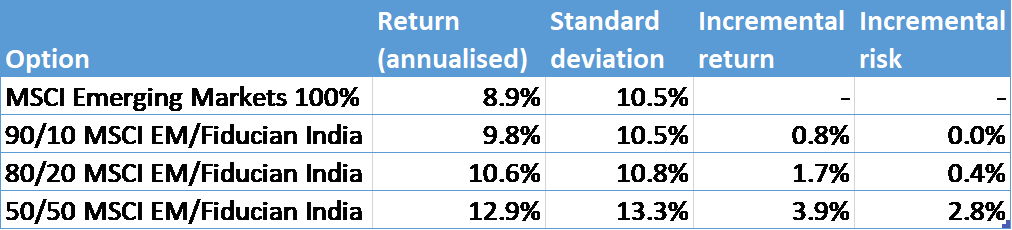

Investors may consider an investment in India as a part of a broader emerging markets allocation in their portfolio. The low correlation to the MSCI Emerging Markets index provides the opportunity to potentially enhance returns at only a small increment to risk by including the Fiducian India Fund as a distinct part of an emerging markets allocation.

The following table shows the risk and return metrics of blending the Fund with the MSCI Emerging Markets Index at different levels based on the last ten years of data.

Due to the higher return of the Fiducian India Fund compared to the MSCI Emerging Market index over the last decade, including it as a part of an overall emerging market allocation would have enhanced returns.

But the impact on the risk metrics turns out to be very minor, despite the headline standard deviation being almost twice as large for the fund. For instance, compared to a 100% allocation to the MSCI Emerging Markets Index, holding 20% in the Fiducian India Fund would have enhanced returns by 1.7% per annum, but only increased risk (as measured by standard deviation) by a relatively minor 0.4%.

Beyond this quantitative data that shows the potential for enhanced returns for a small increase in risk based on historical observations, there is also a fundamental case to tilt emerging market allocations towards India.

High growth and regulatory reform

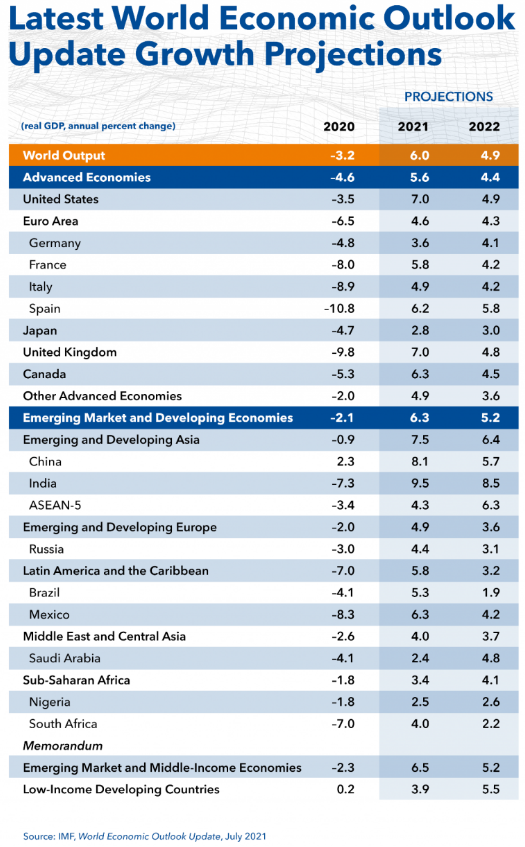

The Indian economy has a number of strong tailwinds. In the near term, India is projected to be the highest growing major economy in the world in 2021 and 2022, according to projections from the IMF:

The economy is recovering well from the COVID-19 pandemic with positive trends in consumption, capital spending and strong growth in corporate earnings.

In addition to the growth forecasts in the near term, there are a number of structural drivers that are poised to set the country up for growth over the coming decades. The country has a population of around 1.4 billion people with an average age of 29 years (compared to 37 years for China) and an urbanisation rate of 35% (compared to 61% for China). There is a young, highly skilled and urbanizing workforce.

On top of the positive demographic factors, the Indian government continues to pursue a pro-growth economic reform agenda.

Land reform initiatives over the last several years have aided the development of a growing manufacturing sector and tax rates have been lowered. This has lured a number of large multinational companies to increase their manufacturing base in the country, with Apple, for example, committing to shift a large proportion of their manufacturing to the country over the next five years to move away from a reliance on China.

Additionally, as one part of the economic response to the COVID-19 pandemic, additional reforms have been made to the agriculture sector and to labour laws that will further liberalise key segments of the market. On top of these big picture policy changes, a number of smaller microeconomic reforms are ongoing, with the view to support high growth rates into the future.

How much exposure do you have?

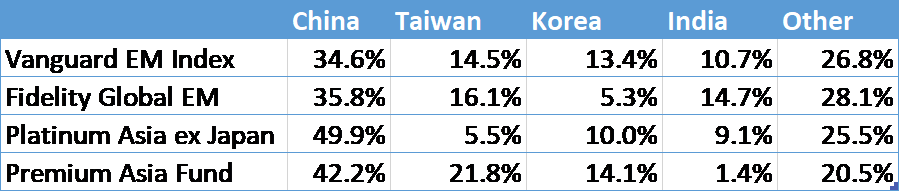

Emerging market and Asia focused equity funds are typically dominated by China, with India making up a small allocation. This is largely due to the relative sizes of each economy. Despite having similar populations, the Chinese economy is approximately five times larger. The table below highlights the country weights for some popular funds.

Across this group, the average exposure to China is 40%, and the average exposure to India is 9%.

Given the weight of China in these funds, the prospective returns will be driven in a large part by the performance of the Chinese equity market.

Uncertain outlook for China

There have been a number of regulatory shocks to investors in the China market over the last 12 months. In an effort to counter growing levels of income inequality, the Chinese government is pursuing a number of policies under the banner of “common prosperity”, with an objective of increasing the incomes and wellbeing of the population.

Late last year, the mooted US$34 billion IPO of Ant Group was shelved as regulators sharpened their focus on the popular payments company. The multi-billion dollar TAL Education Group, along with many others in the industry, lost 95% of their value following moves by the Chinese government to ban for-profit after school tutoring. And in August, the government announced that children and teenagers under the age of 18 will only be allowed to spend three hours per week playing online games, hurting stocks in that sector.

Economic growth in China is still projected to be strong in the coming years, but increasing regulatory risks presents investors with a new challenge.

Does India follow the China path?

The China growth story over the last two decades has been remarkable, and substantially driven by strong central government policy direction and an export and infrastructure led growth strategy.

The trajectory for India is likely to be slightly different. Current policies are geared towards increasing consumption, growth in the services sector and increasing the efficiency of markets. Politics will also play a part. Whilst the democratic system of government in India, combined with a relatively high degree of autonomy for individual States, has historically acted to slow the pace of change, the checks and balances involved will hopefully provide less regulatory shocks than has been observed in China is recent years.

So overall, the pace of growth may not maintain the 8-10% per annum levels seen in the boom years of China’s growth over the medium term. But the growth rate is still predicted to remain high, at around 6-8% per annum, and the path should be a little bit more predictable and stable.

Conclusion

The Fiducian India Fund has provided investors with strong returns over the last ten years, particularly in relation to other emerging market equities.

Despite a relatively high level of volatility, this is mitigated by the fact it exhibits a low correlation with many other equity markets. This means that the incremental risk of an allocation to the Fund can actually be quite low as a part of a well-diversified portfolio.

Emerging market equities offer investors exposure to high growth economies, but the underlying composition of these funds needs to be considered. This is especially true given the large weighting that is typically held towards Chinese equities, and the regulatory risks that have recently emerged in that market.

The economic growth prospects for India appear very positive in the coming years as the country bounces back from the COVID-19 pandemic and continues to implement a positive reform agenda, and an allocation to Fiducian India Fund will give investors a pure exposure to this theme.

Disclaimer

Issued by Fiducian Investment Management Services Limited (ABN 28 602 441 814, AFSL 468211) (‘Fiducian’). The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. The information in this document is given in good faith and we believe it to be reliable and accurate at the date of publication. Fiducian and its officers give no warranty as to the reliability or accuracy of any information and accept no responsibility for errors or omissions. The information is provided for general information only and is not personal advice. It does not have regard to any investor objectives, financial situation or needs. It does not purport to be advice and should not be relied on as such. Investment and tax advice should be sought in respect of individual circumstances. Except to the extent that it cannot be excluded, Fiducian accepts no liability for any loss or damage suffered by anyone who has acted on any information in this document. Past performance is not indicative of future performance and we do not guarantee any particular performance or any specific rate of return.